The EU Wants to Cynically Use War for Debt Bonanza

The Idea is to Use the War as Political Cover for Massive Joint EU Bonds Issue

The European political and financial elite knows that the war in Ukraine is lost but wants to use it as a way to reach “strategy independence” from the United States. As CDU leader and future chancellor of Germany Friedrich Merz said right after his electoral win on Feb 23rd: “It will be an absolute priority for me to strengthen Europe as soon as possible so much that it gradually really achieves independence from the United States.”

Such “strategic independence” needs money and investment – a lot of it, not only to boost defense but much else beside, like energy and innovation; areas in which Europe is lagging behind the US and China. There have been public complaints in Europe about this for quite some time. In order to have the pretext to implement this spending plan, the idea among the EU elite is to make sure that the war in Ukraine does not end quickly. That way the conflict can be used to justify artificially injecting money into the moribund EU economies.

First, there was a question of providing €20 billion euros of additional military support for Ukraine and that the EU self-imposed fiscal rules to be loosened using the existing “escape clause” in the event of “exceptional” circumstances, such as the bogus “defense of Ukraine” excuse. As Bloomberg stated, “under this plan, EU nations would be exempt from debt and deficit limits when financing military expenditures. This marks a fundamental shift in EU financial policy, as such exemptions have previously been impossible under EU rules.”

The EU elite does not want to follow the arbitrary EU fiscal rules: for France the 3% limit of budget deficit to GDP is politically painful, and for the Germans the limit of max 60% of GDP in terms of federal public borrowing seems like an artificial constraint.

Then there was the talk a “huge” euro defense package. Newsweek stated that : “German daily newspaper Berliner Zeitung reported that Baerbock said the package could be worth some 700 billion euros ($732 billion); however, that figure wasn't in the Bloomberg article cited by the publication at the time of writing.”

"We need to spend on defense fast, and a lot; hundreds of billions need to be spent immediately," [Lithuanian Defense Minister] Sakaliene said. "We will all have to move fast, Germany included." Bloomberg wrote the following, with German FM A-L Baerbock’s quote in blue:

It is possible that the amount will ultimately be much higher; French Business newspaper Les Echos now cites a study by the Molinari Institute which speaks of €15 trillion, which would be absolutely unprecedented. The longterm economic consequences would be significant, as explained below.

The official slogan of “help Ukraine defend itself” will give the EU political and financial elite an excuse, or a reason, to turn on the spigots of the European Central Bank at full thrust again; to shower the entire European economy with “free” money, and shore up its fragile economies, like it did after the euro crisis of 2011, with the enormous COVID recovery fund in 2021, as well as with the Green Deal.

Doping EU Economies with Joint EU Bonds

This time it seems that the idea is to use joint EU bonds. Reuters writes: "The bigger amounts will have to come from some type of centralized funding, because most budgets in Europe are relatively stretched," he added, “particularly in Italy and France."

This idea has been pushed recently, including in the infamous Draghi Report (p66) from Sept 2024:

Joint EU bonds are against the whole EU economy and would thus entail a low risk and a lower interest rate as opposed to the normal country-level euro-denominated bonds. This is perceived as necessary in order for the EU to hold its own in competition with the USA and China, two countries that already have unified capital markets, as a speech Draghi to the EU Commission last year made very clear.

There are three main sources of war financing: printing money (seigniorage), increasing taxes, and borrowing. Just printing is difficult in the current economic and political climate. Bloomberg noted that if the spending were funded with tax increases, or cuts in other areas, that could wipe out any positive impact—or worse. So making available around hundreds of billions for the EU would likely be based on debt issued from joint EU bonds;

And any immediate spending on the military would not help Europe because it would be mostly spent buying US weapons.

“One factor limiting the stimulus to be had from rearmament is that Europe buys much of its military gear from American suppliers. Former European Central Bank President Mario Draghi’s competitiveness report estimated that 78% of purchases come from production outside the EU—and 63% from the US alone”.

Therefore, what the EU elite has in mind now is likely to put in place what Mr. Merz said; an attempt at “strategic independence” from the US through a huge investment boom by joint EU bonds, released and used over the long term in order to slowly build up Europe’s industry, not only in the defense sector but also in other sectors. This is the idea, at least...

The EU Debt Plan is About Centralizing Financial Control

In a sense, this would-be debt plan is just the European Union emulating the United States’ old game plan of using war for crony capitalist benefits, finally “understanding” how to cynically exploit the Ukraine war, just as the US has been doing since 2022 by feeding its Military Industrial Complex. But in order for this to happen, the war must not end too soon for the European elite, which is why efforts are made in order to – outrageously - spoil any US peace plans and get the war to continue for now.

This plan is the typical Keynesian militarist spending plan that European states were up to already from WWI and onwards - and not only the fascists and the nazis, as John T. Flynn’s showed in his essential book, As We Go Marching.

The consequences over time of this public spending spree will be as disastrous for Europe as they are obvious of course, as any student of the Austrian School of Economics knows. It will, as always, lead to price inflation, it will devalue the Euro currency, it will inflate bubbles, it will distort EU economies, it will lead to malinvestments, and last but not least, it will leave small European businesses, the backbone of Europe’s economies, hanging out to dry. It will just kick the can down the road and allow EU governments to postpone dealing with their real structural problems, both economic and political. This is particularly true for France.

But all this is beside the point for the European elite, because from their point of view this spending will artificially boost GDP in the many member states, it will create qualified jobs with the defense and energy sectors all over Europe and thus absorb some of the systemic unemployment which is a consequence of decades of heavy state interventionism. It will allow further centralization and harmonization of European economies to the benefit of Bruxelles, as it will instead drive for common defense platforms instead of the fragmented patchwork of defense suppliers that exist in Europe today. As usual, the interests of the ruling minority diverge from the interest of the disorganized and ruled majority.

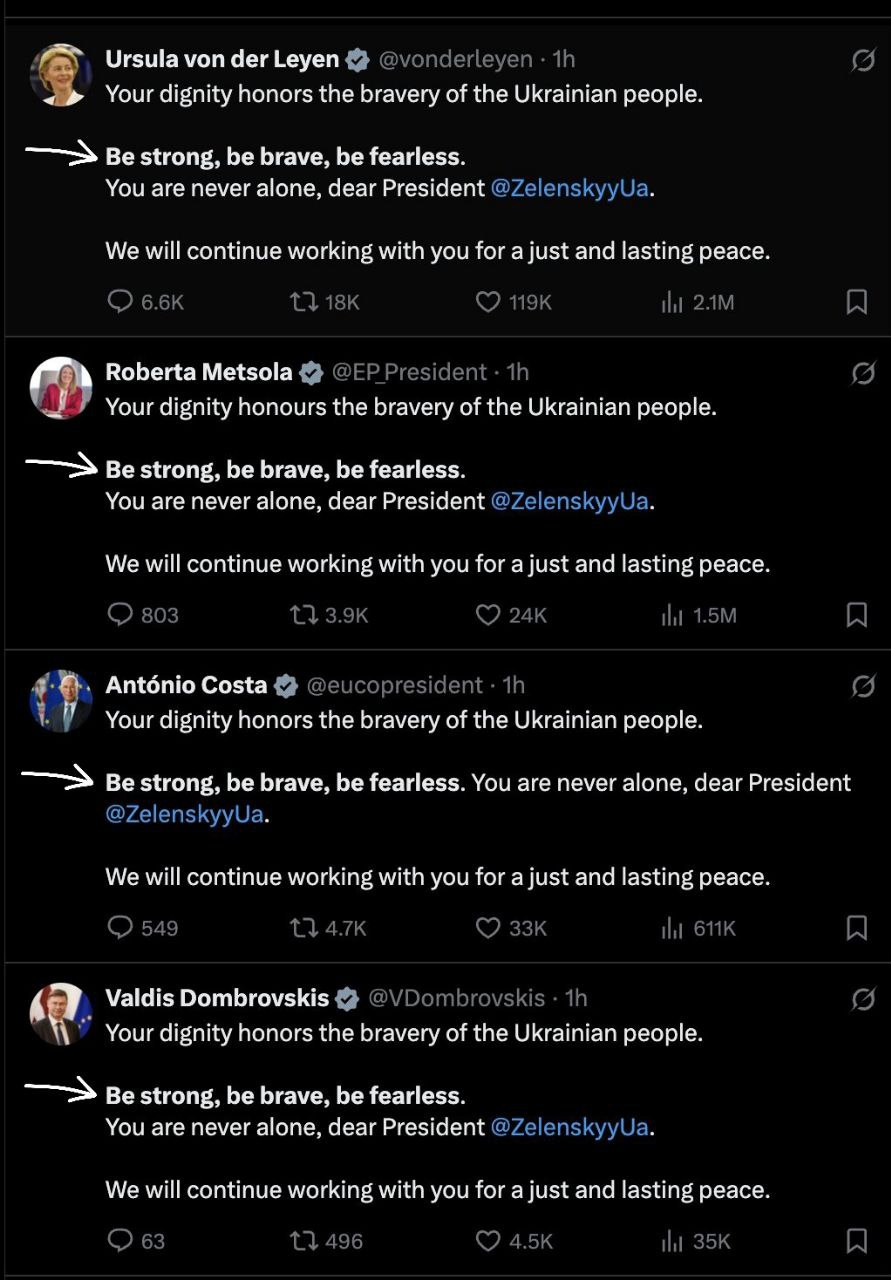

Finally, it will make current EU politicians more popular than now (which, admittedly, isn’t hard), and it will benefit their careers and most likely their personal wealth as well through all the kickbacks that they will get. The President of the European Commission, Ursula von der Leyen and many other EU parasites already know this type of “business” well. If Macron can help to pull this mega-operation off, his future in the EU is assured.

This, at least, seems to be the plan. There should not be much political opposition to it, since it would be political suicide to oppose a plan that “not only will make Europe great again (MEGA), but also safer (from Russia)!”. The confirmed victory of Merz’s CDU in Germany already made the potential political opposition from the AfD lighter.

Ukraine’s coming defeat will probably not derail this plan as long as this defeat is postponed for some time. On the contrary; that is the beauty of it: it will enhance the joint EU bonds financing plan, and convince the public of the foresight (sic) the European political and financial elite had to start developing military and defense industries, even before the defeat of the Bandera regime in Kiev. That is why for the Europeans there must be no peace for Ukraine, at least not now. Poor Europeans and, even more so, poor Ukrainian people.

This just came in today Sunday 2/3/25 confirming my take above :

French President Emmanuel Macron said that Europe needs to invest hundreds of billions in common European defense. “We will give a mandate to the European Commission to define our capacity needs for a common defense,” Macron said in an interview published in several French newspapers on Sunday. “This massive funding probably reaches hundreds of billions of euros.”

It has arrive this morning 4/3/2025 , as expected from the EU Commission:

https://ec.europa.eu/commission/presscorner/detail/sv/statement_25_673

It starts with 800Billion in a more classic financing way, and then towards the end , it says:

"we will propose additional possibilities and incentives for Member States that they will decide, if they want to use cohesion policy programmes, to increase defence spending.

The last two areas of action aim at mobilising private capital by accelerating the Savings and Investment Union and through the European Investment Bank."

This is where the additional instruments, EU bonds, and even potentially private savings could be called upon.

"Maria Luís Albuquerque, Commissioner for Financial Services and the Savings and Investments Union said: “The scale of investment required to ensure EU competitiveness while addressing the clean and digital transitions is massive. To succeed, we need a well-functioning, efficient, deepened integrated capital market and banking sector that brings together savers, institutional investors and companies. My vision is simple: I want European savers to earn a fair return on their savings. And I want European businesses and innovators to have access to the financing they need to drive our economy forward. I want everyone to be able to find the right counterpart, and the right opportunity under the Savings and Investments Union. I warmly invite all stakeholders to help steer it in the right direction.“

https://finance.ec.europa.eu/news/commission-seeks-feedback-savings-and-investments-union-2025-02-03_en