EU's Financial Power Grab Amid Ukraine War

Bruxelles Tries to Take Financial Control of Europe, Europeans Need to Wake Up!

Considering what plans the Ukraine conflict is triggering on the Old Continent, it seems necessary to dig into this financial power grap that is being quite openly proposed to the European publics. But since this news isn’t really much covered in the MSM, most Europeans are unaware of what is about to happen.

Macron’s Revealing Press Conference

A good starting point is French President Emmanuel Macron’s press conference in Bruxelles on March 6th, right after an Ukraine Emergency Summit. It was yet another quite explicit confirmation of how the EU elite is planning to use the Ukraine war as a springboard for increasing the EU’s financial control over the euro zone first.

Macron is a key person to watch in this regard, not only because he is a globalist and a WEF Young Global Leader, but France is currently sickest man of Europe; there is an implicit interest not only for France, but also actually for all the members of the EU and Bruxelles itself, to make sure it receives new preferential debt. To be blunt : France needs to be saved externally as it has become clear that France does not have the political capability or will to “save” itself.

There were many interesting parts in Macron’s press conference, but here are key financial parts:

« Common funding, because I believe that the freedom, the budgetary space that is left at national level is not a satisfactory solution because there are many differences between Member States. And if we really want to have major European programmes and a European industrial base, we need European funding, and so what we are going to support is indeed that we can move towards innovative financing.”

“Some suggest having the ESM as an underlying mechanism, I am for my part in favor of looking at this solution, but at a European loan for defence, which would, moreover, make it possible to look more widely for the financing of major defence and artificial intelligence efforts”

“Such financing is all the more relevant as it would allow us to handle what will otherwise hit very quickly our economies, namely the beginning of the repayment of the loan made during the COVID period that will happen from 2028 onwards”.

“We need to give ourselves depth of field and when we look at the aggregate level at the European Union or even the euro area, we have an underdebtedness of this area compared to the USA which gives us a lot of space, and I stress that.”

“The Draghi report and the Letta report have shown this very well over the next 5 to 10 years, and the geopolitical situation is accelerating this. These are the 5 to 10 years when we have massive investments to make if we Europeans want to rise to the height of the threat.”

If we want to meet the investment needs in artificial intelligence because the race is now and if we want to meet the challenges of decarbonizing our economies on precisely all the so-called green technologies and therefore the priority, It's about mobilizing common funding.”

So what Macron is actually saying on behalf of the EU political and financial elite:

We will use the “Russia threat” as an excuse for trying to achieve “strategic independence” (from the US).

We think defense is not the only priority because this is not about helping Ukraine; we want spending also in AI, Energy, and many other areas.

We need massive money creation however possible, but preferably via joint EU bonds in order to benefit from Germany-level interest rates

We think the Letta and Draghi reports are key docs for our strategy of financial control of Europe.

We want to copy the US in spending (despite not having a reserve currency). We don’t care about long term inflation or living standards of EU citizens.

We need to handle upcoming debt repayments but our economies are in the doldrums and we don’t want reform towards freedom, so we borrow more.

Debt, Baby, Debt!

Firstly, it should be remembered that credit expantion by the state always ends up harming society as a whole. As Ludwig von Mises wrote in Human Action (1949):

“The objective of credit expansion is to favor the interests of some groups of the population at the expense of others. This is, of course, the best that interventionism can attain when it does not hurt the interests of all groups”.

It is interesting to look at the Covid Recover Fund that Macron mentioned, as something similar may happen now again, but with more loans than grants:

The debt repayment from 2028 that Macron mentioned is going to be a burden that the EU elite wants to handle with even more debt:

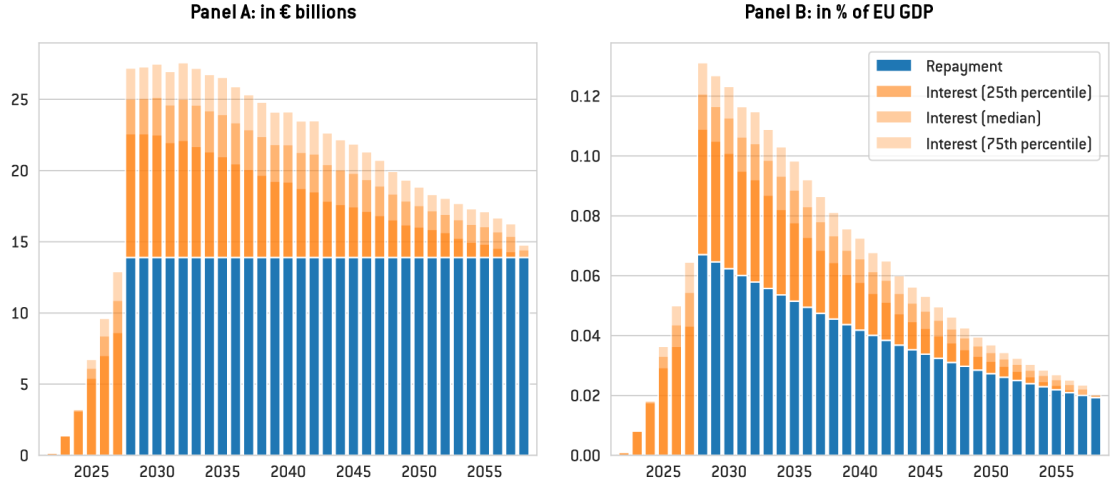

“The annual principal repayments will be around €13.9 billion from 2028 to 2058. Starting in 2028, the EU will thus be required to allocate significantly more money to service its debts. At the 50 percent confidence interval, the total annual financial needs could reach between €22 billion and €27 billion in 2030 (respectively 0.11 percent and 0.13 percent of EU GDP), before declining gradually towards €13.9 billion at the end of the programme. In total, for NGEU non-repayable support to EU countries, between about €582 billion and €715 billion will likely be spent to pay interest and to reimburse the debt.”

Joint EU debt is again seen as the most attractive instrument to use for the EU and the national governments, mostly because the dire situation of the main EU economies do not really allow much more standard borrowing or money printing. As Macron also said, the European Stability Mechanism could be used as during the Greek crisis, but joint issuance of EU debt is preferred. The markets are even looking forward to them, but the question will be at what actual interest rates.

The “beauty” of such debt from the point of view of the EU elite, is that it is complicated for most EU citizens to understand, it takes its sources far away from the populations, and the negative effects on society (eg in terms of inflation, not least the Cantillon effect), are very indirect. Robert Higgs wrote in his well-known work, Crisis and Leviathan, that : “obviously, citizens will not react to the costs they bear if they are unaware of them. The possibility of driving a wedge between the actual and the publicly perceived costs creates a strong temptation for governments pursuing high-cost policies during national emergencies.”

Higgs called the “Ratchet Effect”, “the tendency of governments to respond to crises by implementing new policies, regulations, and laws that significantly enhance their powers. These measures are typically presented as temporary solutions to address specific problems. However, in history, these measures often outlast their intended purpose and become a permanent part of the legal landscape.” This new financial reality in the EU that will be born out of the Ukraine crisis will precisely become “permanent part of the legal landscape”.

Recently the Covid-19 crisis and the Climate crisis, among others, have been used in this way to increase government control. Today, it is the Ukraine war, or the militarization of Europe (sic) that “justifies” indebtedness to finance “growth” and “independence”.

Europeans, Beware the Danger Ahead !

The success of Europe - not the EU Commission or Council, not even of the EU nation-states, but the success of the European citizens - does not depend on such state interventionist policies. On the contrary, these policies have the opposite effet : increased state role in society, centralization of power, price inflation, further erosion nation-state sovereignty and increased bureaucracy. But they will do little good for the real entrepreneurs that are the backbone of the European economies.

Of course, the massive spending will initially generate an artificial and euphoric feeling of wealth, and even ineffectually create some growth, as hundreds of billions wash over the overtaxed and overregulated European economies. But this is just delaying the inevitable political and economic backlash that will come, years down the road.

There is indeed a need for better competitiveness and more independence for Europe, but this can only be achieved if the EU and the nation-states start loosening their stranglehold on the economy. In other words, what is needed is more free market - the opposite of the interventionist initiatives that are about to be unleashed on Europe.

All these financial EU proposals are meant to give Europe “strategic independence”, a word much in vogue right now. The EU elite now seems to envisage a great three-party power struggle with the United States and China. But such a geopolitical competition cannot be in the interest of European consumers, who would then see further restrictions on free trade with companies from these two nations. The only natural competition is economic - not political - and exists between enterprises and individuals in the free market.

It is now obvious for anyone to see that the EU has gone far beyond its original goal of securing the four freedoms across European nations. After the undemocratic ratifications of the Maastricht treaty of 1992 and the Lisbon treaty of 2008, the EU is now pushing ahead with its agenda of globalist financial control, at the expense of Europeans who have no say in the matter. Democracy is and has always merely been a chimera, as must now become clear for more and more people.

The EU project, and the European mostly globalist governments that have treacherously supported this program over many decades, is wreaking havoc on the entire European civilization through decades of coercive policies. If Europe is to shine again economically, scientifically, and culturally, the plan for EU financial control must be stopped.

i would enjoy a good read on CBDC's. Certainly appear as if they will create more monetary chicanery opportunities..

I don't think I have ever met a European libertarian even though Mises and Hayek originated much of the modern libertarian monetary thinking. Can't use the word 'liberal' anymore to describe their writings. Too many Americans and Canadians will think I am writing about Democrats.

To me, there are quite a few good writers on Substack. The problem is you are preaching to the choir in most cases. I suppose as events continue to sour more people will start searching for sensible solutions.

Got a bit of your first piece to finish reading. Thank-you for your efforts.

No one ever said living in a dystopia would be easy.