Beware the Dangers of the Digital Euro

The Digital Euro is a CBDC that can easily be used to increase state control over society

In a March 2025, French president Macron held a revealing speech, in which he among other things called for the introduction of “innovative financing” in the European Union. Among the things he meant was clearly the introduction of a EU digital currency. Indeed, Christine Lagarde (in France remembered for her revealing “Use Me” letter to Nicolas Sarkozy), the totally subservient globalist head of the ECB, recently confirmed that the plan that they have been working on for more than five years, namely the introduction of digital euro, a CBDC, is planned for October 2025.

This is not a coincidence. The on-going geopolitical whirlwind has been exacerbated by the bellicose attitude of the EU towards Russia. The goal for the EU elite is to reject peace in Ukraine until it can get all its financial tools in place; from the massive spending programs and joint EU bonds, to accessing private savings and the introduction of the Digital Euro.

The ECB explained how wonderful the introduction of the Digital Euro will be for all. It is true that it could bring a whole host of advantages for transactions, such as “incorporate rules, smart contracts, digital signatures and an array of other new tools.” But, as an article on nakedcapitalism noted, there is no demand for it from the people:

“And let’s be clear: this will not be a bottom-up revolution. There are no European citizens marching in the streets calling for a digital euro, for the simple reason that most people already believe they are using a digital euro currency every time they pull out their card or mobile phone.”

Dangers to Liberty

Yet, the introduction of the Digital Euro poses clear danger for individual liberty, especially considering past illiberal behavior of the EU technocrats, from Covid mandates, to “need” for Digital passes, to support for sanitary lockdown measure, to election meddling, to control of freedom of speech. This is particularly true if at the same time, limitations on the use of cash continues de facto and de jure. As was written on nakedcapitalism:

“If the ECB, EU Commission and national EU member governments were to accelerate cash’s demise by penalizing its use (while incentivizing the use of CBDCs), we would witness the loss of one of the last vestiges of financial freedom, privacy and anonymity.”

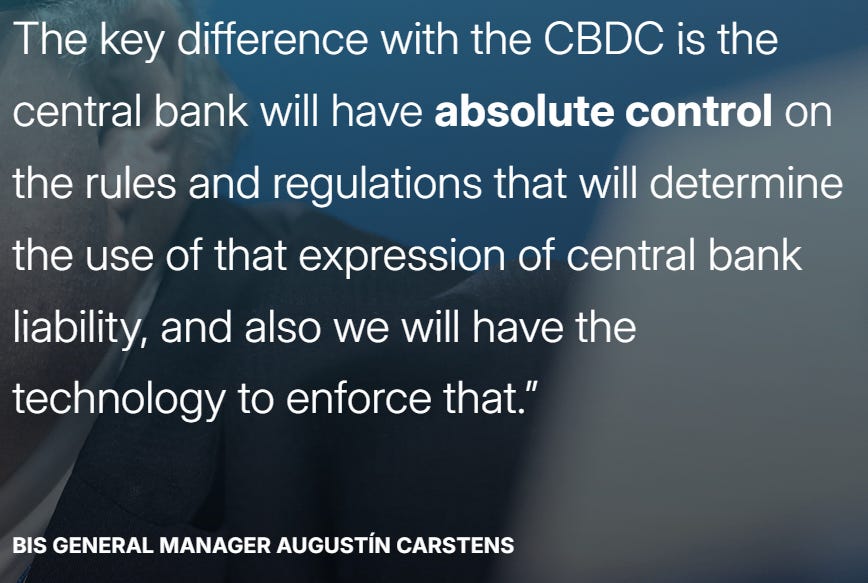

Indeed, a Digital Euro (based on DLT, (Digital Ledger Technology which is based on block chain), will give enormous potential power to the state agencies controlling it.

Digital currencies therefore clearly involve risks of state overreach and coercion. The Cato Institute issued precisely theses warnings in an essay explaining “Why Central Bank Digital Currencies Shouldn’t Be Adopted”.

It could give the EU and its relevant institutions the possibility of “freezing and seizing of assets, effectively locking an individual out of society”. It could introduce “programmable spending, meaning that people could be prohibited from buying certain goods or limited in how much they might purchase.” In sum, a CBDC like the Digital Euro could allow technically (if not yet legally) the surveillance, the identification and the limitation of any transaction(s) from any individual(s).

There is already at least one example (Nigeria) where part of this nightmare has already occurred, as a recent article from the Mises Institute makes clear:

One need only look at Nigeria’s eNaira to glimpse the possible future of CBDCs. Introduced in 2021 following a cryptocurrency ban, the eNaira was supposed to usher in a new era of financial stability. Instead, it became a tool for government control. Initially framed as a way to reduce physical cash transactions and promote digital payments, it soon encountered significant obstacles, including volatility, high transaction costs, and a lack of transparency due to its closed, centralized blockchain.

The Nigerian government imposed strict limits on eNaira wallets, including daily withdrawal caps and balance restrictions. Despite government promises that physical cash would remain in circulation until the eNaira was fully operational, over half the population was left holding worthless old banknotes.”

Therefore, if one has the slightest doubt that EU and its various institutions are not entirely trustworthy and are not completely dedicated to the freedom and wellbeing of its citizens, then one should immediately reject the Digital Euro.

Considering the continuous EU anti-democratic tendencies, expressed by such Orwellians statements from EU Commission head, Ursula von der Leyen, as: “we have tools” to bend EU democracies to our will, and the wish - to use her “newspeak” - “prebunk” information that is not to EU liking, the answer should be clear to all…

There is no way around having a serious government. So people should concentrate their effort in getting a serious government.

The CBDC will certainly make it easier to pull off a "Greece" and a "Cyprus". Divert any excess cash in your account to those sound investments in the MIC that ain't going to happen.

"Excess cash" being what a Eurocrats decides, not you.