The EU Elite Also Wants Access to Private Savings

They Want to “Pull Trillions from Collective Couch Cushions” as Italian ex-PM said!

This is now the fourth straight article on Europe’s financial shenanigans on this substack. That was not the intention initially, of course, but considering the reckless and immoral power grab that the EU political elite is now contemplating, there was no choice but to address this situation at some length. Especially since MSM this hardly addressing it at all.

It is important to remember that the EU elite has constantly undermined its own position since the start of the Ukraine conflict, and what is worse: undermined the standard of living and growth perspectives of the Europeans. The true purpose now of continued belligerence towards Russia and a support of Ukraine to the hilt is to trigger massive spending programs in order to drive EU centralization and control from Bruxelles.

The three previous articles reviewed the European plans using the Ukraine conflict as excuse:

Firstly, there were clear signs that European policy towards Ukraine was diverging from the United States under Trump. It became clear that the Europeans do not want peace in Ukraine, at least for now. The events of the last few weeks and days have confirmed this.

Secondly, as the EU debt plan started to crystalize publicly from the EU political and financial elite, it became clearer that the EU just wants to cynically use the Ukraine war as an excuse for more debt, to try to artificially dope the faltering big economies of the EU (France and Germany foremost) through a massive injection of funds, mostly through debt.

Thirdly, the financial power grap that the EU political and financial elite is preparing in the context of the very fraught relations with Russia concerns three almost entirely new areas: a) joint EU bonds so as to lower interest rate for all and let, in practice, the more fiscally sane countries subsidize the sick spenders, b) the introduction of the Digital Euro for more control of the European citizenry, and c) the upcoming attempts to access the private savings of European individuals and companies. The two first points were covered in the third article.

The part about trying to access the private savings of Europeans has not yet been covered in the previous articles; this is the topic here.

Getting Access to EU Private Savings

The idea that the EU elite has had for a number of years now is, as shocking as it may sound, to access private savings by proposing “attractive” EU investment instruments to regular Europeans not used to thinking about government agencies as swindlers. But private savings ought to be completely off bounds for State agencies, the first reason being that such savings have already been taxed once (and sometimes even twice!). Yet, the EU elite is salivating at the thought of getting access to private savings of Europeans, in order to cover for years of economic mistreatment and interventionism, which has led to anemic growth in the EU zone, lack of competitiveness and a desperate need for capital.

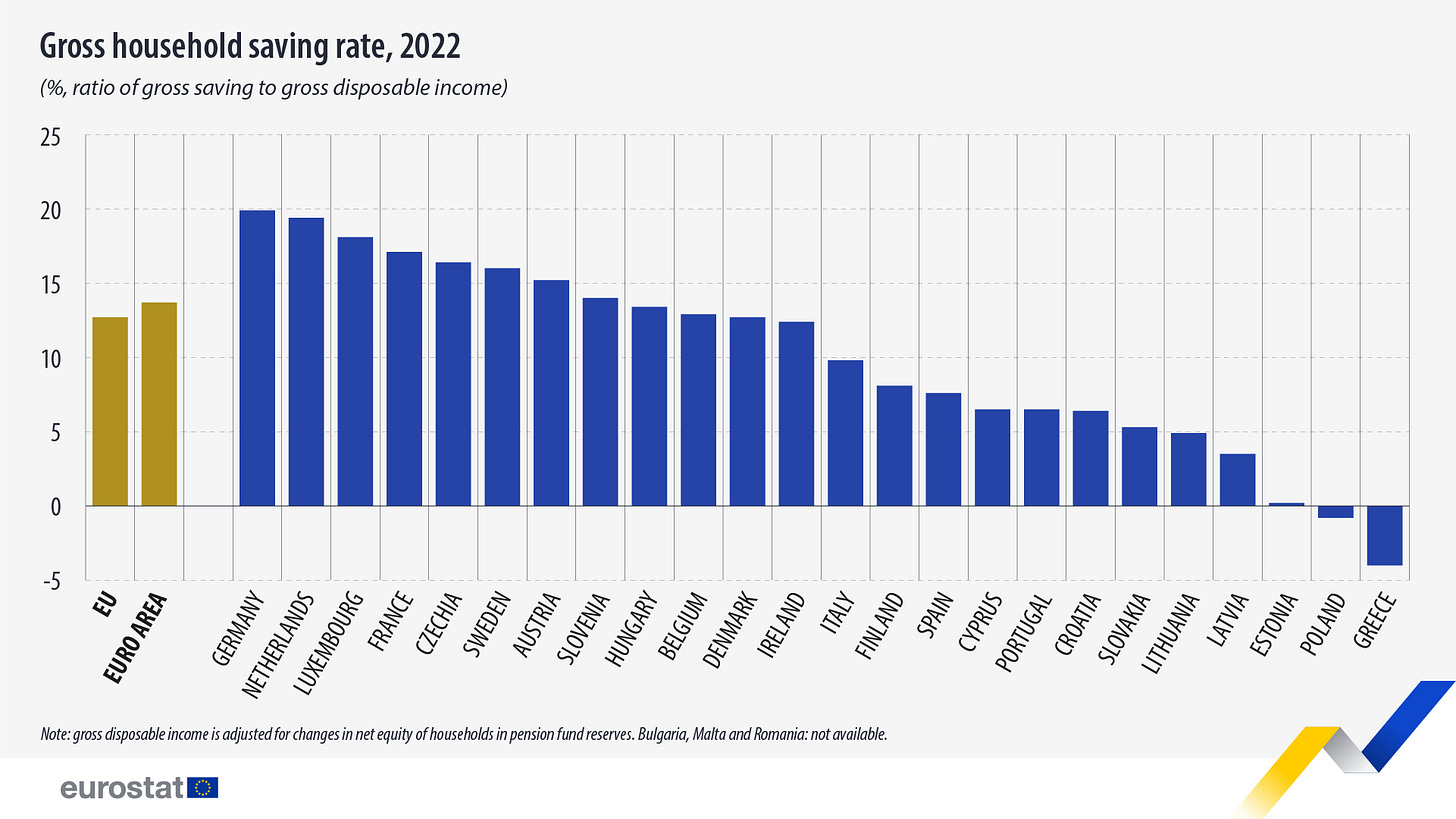

Indeed, Draghi lamented in a 2024 speech that, “the EU has very high private savings, but they are mostly funneled into banks deposits and do not end up financing growth as much as they could in a larger capital market. This is why advancing the Capital Markets Union (CMU) is an indispensable part of the overall competitiveness strategy.”

It’s hardly possible to have a bigger red flag than Draghi openly saying this.

The CMU seems to be an umbrella term covering everything from joint EU debt, ECB money printing (ESM), the harmonization of financial rules across the EU, to dipping into the well-earned savings of European individuals and companies.

Ex-Italian PM Enrico Letta even stated, shockingly, that the aim with the CMU was for the European leaders to “pull trillions from the bloc’s collective couch cushions by offering savers an easier way to invest in stocks”. His report from April 2024, also stated (p26) that “by achieving full integration of financial services within the Single Market, the Savings and Investments Union is envisioned to retain European private savings”

This pro-EU Bruegel think-tank put it more specifically: “The European Union is sitting on €33.5 trillion in household savings, or one quarter of its collective GDP, yet much of this money is stuck in banks because households prefer cash over market investments.”

Shame on households to “prefer cash to market investments”! As if on cue, Macron’s Elysée Palace also declared that “household savings should be enabled to fund more directly the massive investments we need to boost our competitiveness.”

It cannot be clearer, therefore, what the plan is in this regard. These comments tell of institutions that not only want to eventually get rid of cash for increased control, but that first want to use private individual savings to compensate for the failed and rigid European monetary, fiscal, and welfare policies that have been stifling investment and competitiveness on the continent for decades.

This plan is obviously not meant to serve the people of Europe, who have already been almost taxed to economic death or subsidized to apathy. It is to serve the EU political and financial elite. This is clear from the efforts and dedication that unelected EU bureaucrats are putting into this. Here is a finaly reminder of this brazenly public attempt to convince the public to let go of their savings:

What remains to be explained are the practicalities: what kinds of financial instruments, or securities, are going to be marketed and pushed through the banking sector, and then actively and slickly proposed to the European populations?

“Money Is Never Idle”

A bit of Austrian economic theory is necessary now. Savings are a sign of a wealthy economy; a sign that society has resources that do not immediately need to be employed in urgent production. But, as Ludwig von Mises noted, “money is never idle.” Deposits not only reflect individuals’ natural and varying inclinations to save, but as Mises explained in Human Action (1949):

“If the individual saver employs his additional savings for increasing his cash holding because this is in his eyes the most advantageous mode of using them, he brings about a tendency toward a fall in commodity prices and a rise in the monetary unit’s purchasing power.”

Savings are thus deflationary, they increase the value of the money in circulation (providing there is little or no monetary creation). Savings thus also fulfill an important role in the free market. The sentence from Mises quoted above is important because it encapsulates economic fundamentals that are never discussed today. It is an insight that many people understand somewhat implicitly despite the inflationary times that have been foisted upon Westerns and others for decades and that are now considered “normal”. But politicians obviously choose to disregard this key economic learning, for obvious reasons.

In a free society (i.e. not the European Union), savings fulfill an important and naturally calibrating role that should be not incumbent upon any government institutions to create or destroy.

Excellent piece explaining the EU's latest planned malpractice.

It makes sense to me that the WEF's alpha-test for global fascism would commit private savings to fund war production that doesn't exist and probably won't ever produce much.

The EU wants to deindustrialize and manufacture armaments?

"You will own nothing and be (un)happy.", is the more likely scenario, I believe.

Huxley, Orwell, Rand et alia could accurately see our future.

The barbarians aren't approaching Rome. They have already breached the walls..

Thanks for the great writing and continue ringing the bells.

in the USA once was a standard: "no taxation without representation". if a politically led centralized bureaucracy modeled on a political bureaucracy in the former USSR is accepted without objection by the silent majority, this silent majority also deserves to pay for its lethargic behavior. There is no discussion with the EU possible, it is out of reach for the citizens. The EU can only be cut back to the level of a European Economic Union, without privileges for subsidies for spendthrifts for enterprise. Then lobbyist can go home.